- Brisbane, AU

- info@sustinentech.com

Lending Platform

Our Offering

The lending industry is undergoing a significant transformation as it moves away from traditional lending methods towards a more digitally focused approach. This revolution is reshaping the way borrowers access funds, making lending more convenient, efficient, and accessible than ever before.

As part of our Lending platform we bring to you an end-to-end loan servicing solution that includes a comprehensive set of function-driven APIs that are secure and easy-to-use across all stages and from any other platforms within your existing ecosystem.

Our Lending platform is based on a policy-driven simplified architecture that utilizes atomic services to cater to the vast set of features and functions required across lending journeys for various loan products across the lifecycle of a loan – Retail, SME or Corporate finance.

The platform offers numerous sets of pre-defined policies that have been meticulously tested on a sizeable portfolio mix. These policies and guardrails provide for enormous flexibility across the loan lifecycle while keeping the sanctity of product features and data across the entire contract journeys.

These parameter sets are structured in line with the functions and processes across the loan lifecycle.

- Repayment Calculations

- Fees and Charges

- Disbursement controls

- Automated payouts

- Interest Accruals

- Due generation

- Repayment mandates

- Loan Cancellations

- Disbursement Cancellations

- Restructures and Loan variations

- Prepayments

- Receipt allocation

- Late charge calculations

- Early and maturity closures

- Automated and manual waivers

- Transaction Reversals

Launch new offerings quick and easy to stay ahead in the market.

Servicing

Our platform provides you the flexibility to make use of atomic services to achieve transaction results while referring to policies and guardrails applicable for a loan.

Launching new plans is quick and easy – define a plan and pick and assign policies for each stage is all that you need to do.

We provide a robust and flexible API for onboarding new contracts – and the best part is that you can configure additional validation rules for specific fields to ensure sanctity of data for any custom needs.

Take control of what changes you allow to any non-financial loan data by configuring the fields that can be modified including an audit log for all changes made from various channels using the related service.

In addition to the set of specific servicing functions, make use of equivalent reversal functions to enable required corrections to ensure sanctity without the need of corrective adjustments.

A robust accounting engine ensures the financial accounting and any taxation needs are catered to by using defined templates which is again minimal as it makes use of the option to link a set with a product as part of the accounting policy mapping.

And above all you can enable the option of using the system round the clock – daily processes are built to eliminate the need of downtime for end of day processes.

Our core engines have been tested rigorously end-to-end using an automated testing suite for more than 2500 repayment scenarios. We utilize these baseline results to ensure there are no regression issues as a result of any changes introduced.

All this comes with an integrated data migration utility that enables a smooth and quick transition with minimal impacts on peripheral systems.

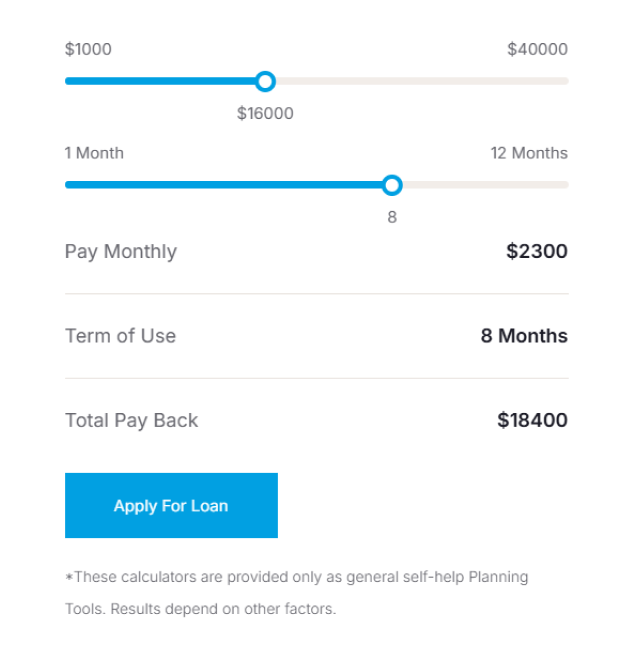

Calculators

We offer a wide range of calculators that can be quickly configured to align with your products and policies and provide a seamless experience to your customers. The calculators include

Repayment schedule

Generate your repayment schedule for a loan based on specified parameters including loan amount, interest rate, term, repayment plan and more.

Borrowing capacity

Derive the borrowing capacity for a loan based on high level inputs

Extra payments

Simulate the results from extra payments by changing the term or the repayment amount to decide what suits you best.

Rate change

Simulate the impacts of interest rate changes on your loan.

Restructuring existing loans

Generate results for proposed changes to an existing loan including change of repayment plans.

Enhanced experience

Utilize numerous function-oriented APIs to provide a seamless experience to users and customers across multiple channels and user interfaces.

Reduced costs

Utilize a single instance to enable the processing of a wide range of lending products across Retail, SME and Corporate portfolios – all the varied features in one system along with the flexibility of executing daily processes for specific portfolios selectively over different slots.

Faster time to market

Configure new products using simple configurations by choosing policies and guardrails from a comprehensive set of pre-configured and tested parameter sets defined for policies which are based on features we have come across different markets over the lifecycle of various lending products from loan boarding through to closures.

Empower customers

Make use of APIs and parameters to give your customers the power to choose the changes to their loans when they make additional payments or request for changes within defined guardrails while keeping controls on many others.

Automate and save time

Remove manual actions by configuring auto-authorize options for certain transactions while keeping control on many others that require another pair of eyes to validate and confirm them.